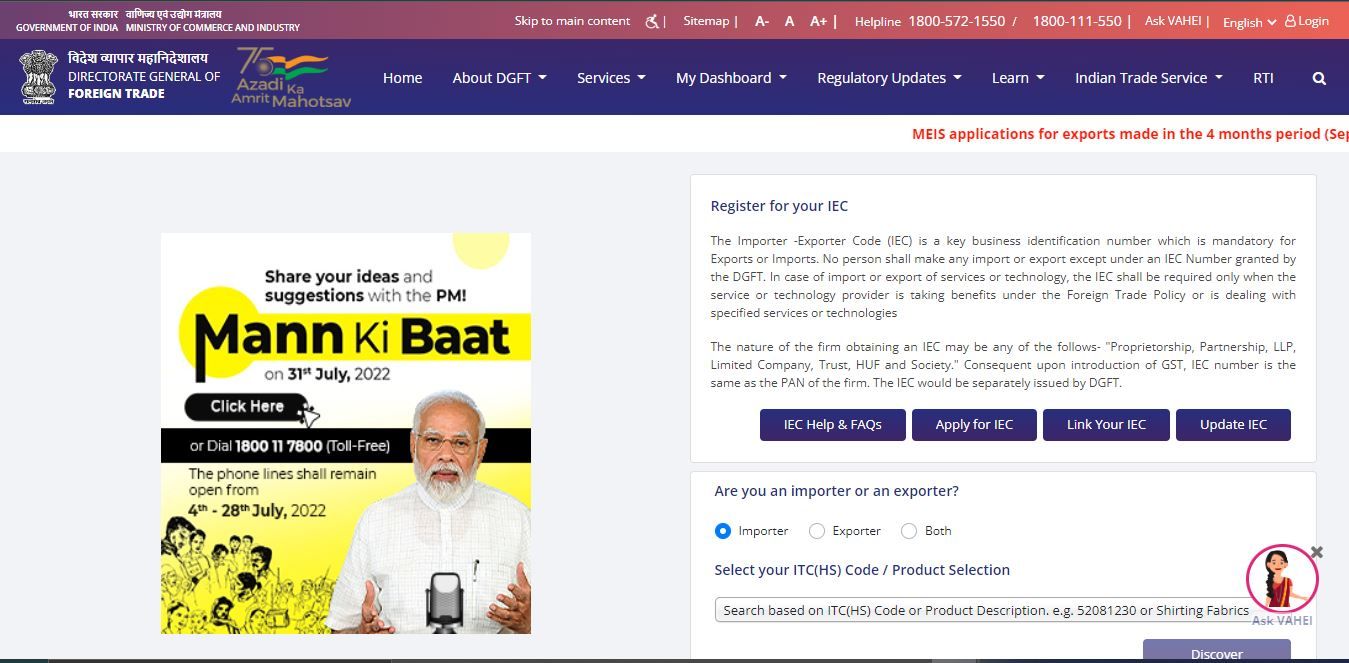

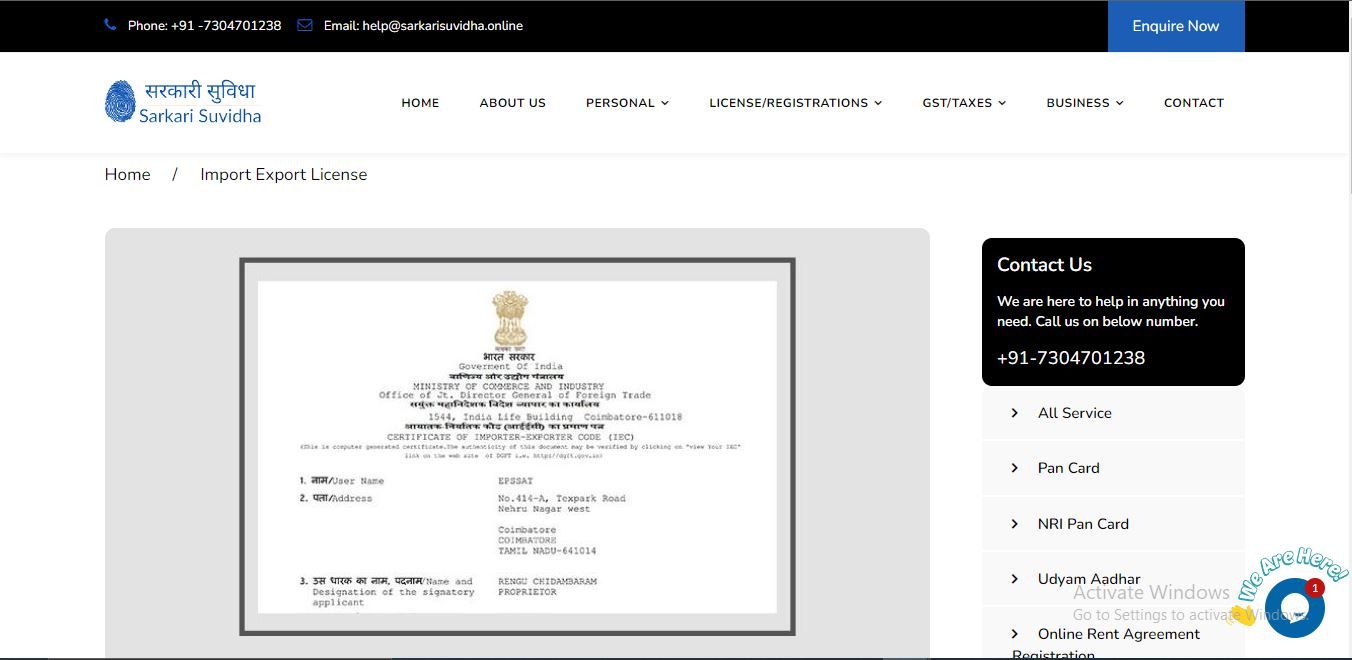

How To Apply For Import Export License In Mumbai?

Undoubtedly, the rapid industrialization associated with globalization has changed the world for the better, making the world compact and more accessible to anything and everyone. It has also made it

Jayesh Vaidya

Undoubtedly, the rapid industrialization associated with globalization has changed the world for the better, making the world compact and more accessible to anything and everyone. It has also made it easier for companies to offer and sell their products and services to customers around the world, earn better revenue, expand their business globally, and access better raw materials to manufacture products through imports and cheaper prices, and best of all, make a profit to achieve a win-win situation for them. However, suppose companies in Mumbai need to export or import products/services regularly. In such a case, they are required to apply for import and export license registration according to current regulations in Mumbai.